The world’s largest companies are under-reporting sustainability policies and performance, hampering investors’ access to data that will allow them to play a full role in the transition to a low-carbon economy, according to a new stock exchange report released by Corporate Knights and Aviva. While Nasdaq Helsinki topped the sustainability disclosure performance ranking for the second year in a row, over the past five years, corporate disclosure rates around the globe for greenhouse gases (GHGs), energy, water, waste, payroll and injuries have flatlined.

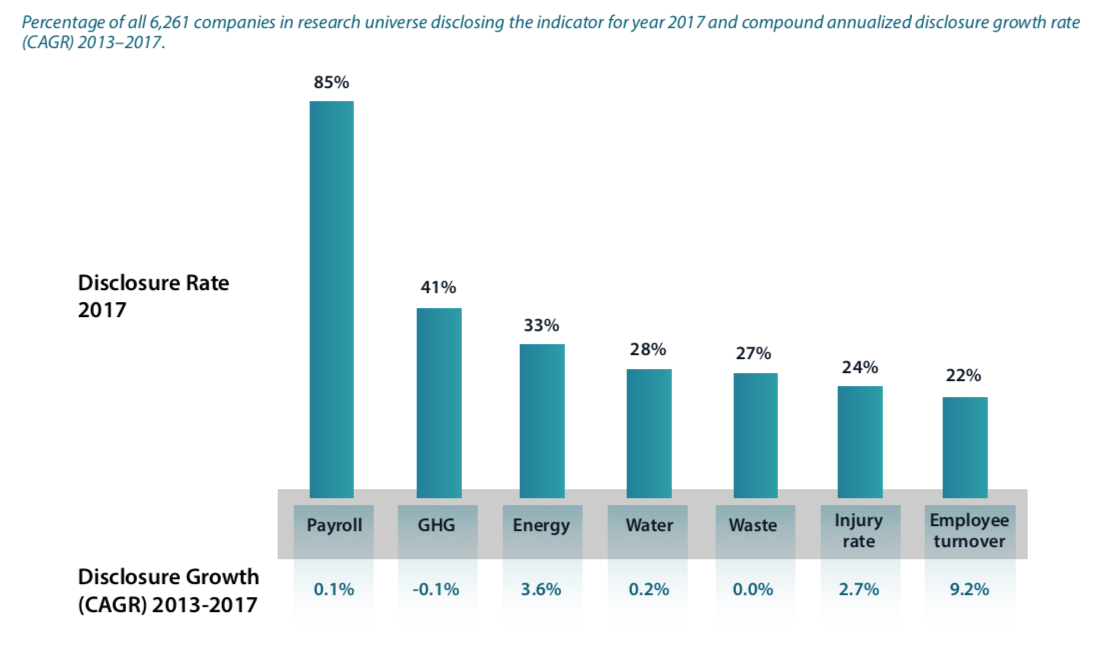

The report, “Measuring Sustainability Disclosure: Ranking the World’s Stock Exchanges 2019,” finds that of 6,261 large companies analyzed, 85% disclosed payroll, followed by greenhouse gases (41%), energy (33%), water (28%), waste (27%), injuries (24%) and employee turnover (22%).

GHG disclosure spiked in 2015 with 2,609 companies (41.7%) disclosing, falling to 2,583 (41.3%) in 2017. Given investors’ surging interest in sustainability data and a host of significant ESG data-disclosure initiatives, including the Task Force on Climate-related Financial Disclosures and the Sustainability Accounting Standards Board, it seems counterintuitive that companies are not disclosing more ESG data.

However, the change in economy make-up, which has become more tech-heavy over the past economic cycle (tech companies tend to disclose less ESG information), and the increased scrutiny and accountability around ESG data, including litigation risks, has caused some companies to pull back on ESG transparency.

“The reporting gap constitutes a glaring governance failure that requires urgent redress, especially given the surging investor interest in sustainability performance metrics,” says Corporate Knights CEO Toby Heaps.

Adds Heaps, “In the short-term, exchanges and regulators should set a mandatory requirement for climate disclosure (building on the recommendations in the Financial Stability Report of the Task Force on Climate-related Financial Disclosures) on a “comply or explain” basis, which can help maintain clear expectations while allowing companies the flexibility they need.”

First commissioned by Aviva Plc in 2012, the annual report tracks corporate disclosure on seven sustainability indicators. It suggests how such disclosure can be translated into actionable key performance indicators, which might help investors to distinguish companies that are incorporating sustainability into their value-creation stories.

Maurice Tulloch, Chief Executive at Aviva says, “The entire economy needs to change quickly for there to be any hope of achieving the ambitions set by the Paris Agreement. In part this depends on everyone having access to the right information about how individual companies are contributing. Global stock exchanges are central to this.”

Which stock exchanges are leading on disclosure?

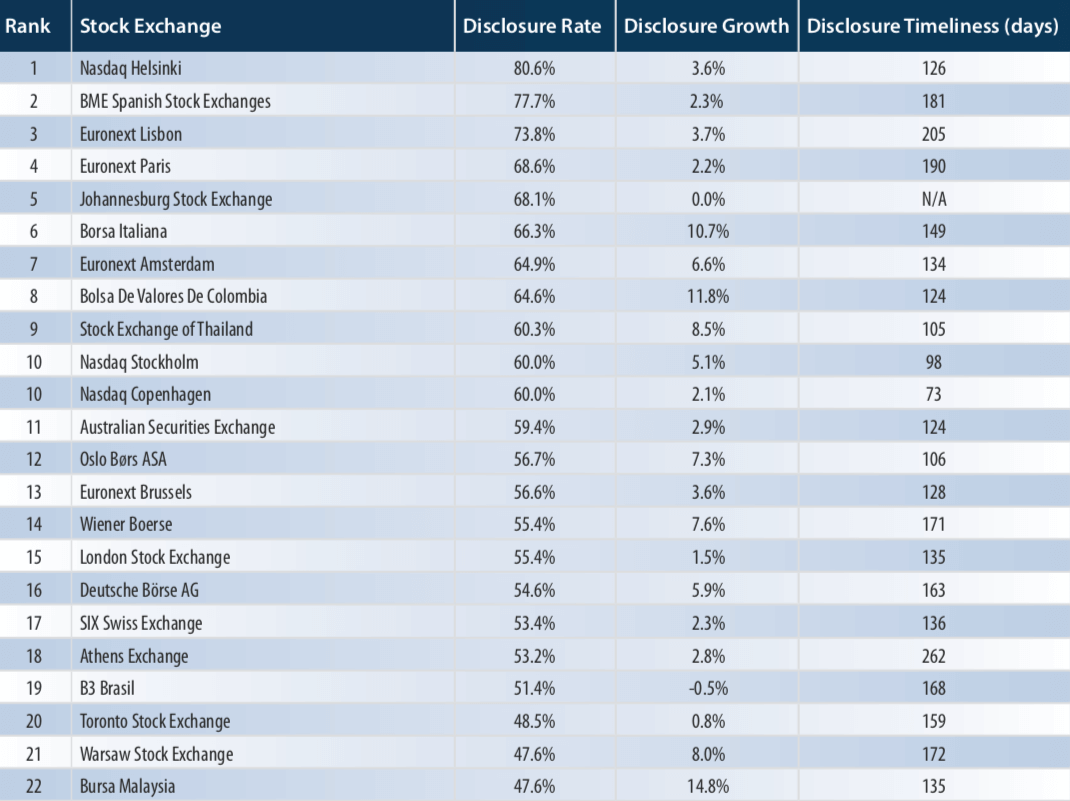

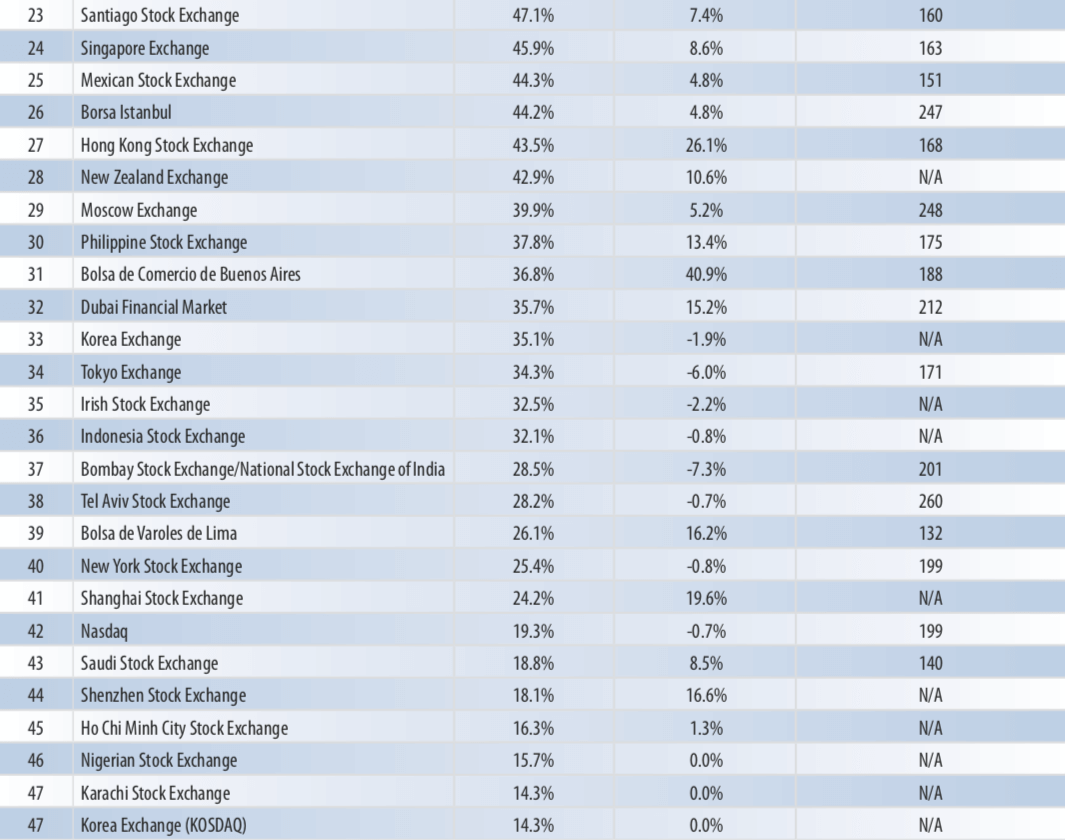

Nasdaq Helsinki topped the disclosure performance ranking for the second year in a row, with excellent disclosure rates across all indicators. Among environmental indicators, the Finnish companies did especially well in disclosing energy use and GHG emissions, which were disclosed by 32 of the 36 companies evaluated.

BME Spanish stock exchanges and Euronext Paris kept their places in the top five, with Euronext Lisbon and Johannesburg Stock Exchange emerging as newcomers to the top five.

The top 10 included three exchanges from emerging markets: Bolsa de Varoles de Colombia, the Stock Exchange of Thailand (SET) and the Johannesburg Stock Exchange (JSE). Their presence shows that sustainability reporting is taking hold in emerging countries.

All of the top 10 ranked stock exchanges have mandatory, prescriptive requirements for sustainability disclosure.

Disclosure increased significantly among issuers on the Argentine exchange, especially for employee turnover, energy, waste and GHGs. The Stock Exchange of Hong Kong went from a GHG disclosure rate of 18% in 2013 to 42% in 2017.

The issuers of Nasdaq Copenhagen were the fastest disclosers, with an average lag of only 73 days between the end of the fiscal year and the release of annual sustainability data: 66% of the companies in the exchange had disclosed their sustainability data within five months of year-end.

The issuers of Nasdaq Stockholm and the Stock Exchange of Thailand also performed well in this metric, with an average timeliness of 98 and 105 days, respectively, compared to the research universe average of 164 days.

Time for regulators to step in?

There has been a proliferation of both voluntary and mandatory regulations to encourage corporate sustainability disclosure around the world and these have, for the most part, been successful in achieving their stated goals.

However, the near zero growth in sustainability disclosure identified in this report suggests that new approaches are needed to spur sustainability reporting anew, especially among those companies that have never published any quantitative sustainability performance data.

The Corporate Knights report encourages stock exchanges, governments, regulators and corporate reporters “to come together to find solutions to the hurdles that still exist in preventing corporations from engaging in sustainability reporting and hence contribute to the attainment of the UN SDGs.”